How secure is Social Security?

Democrats and Republicans both agree - Social Security is headed towards disaster. They just don’t agree on how, and who, should fix it.

WASHINGTON – It’s difficult these days to find anything that Democrats and Republicans in Washington agree on. But we found one — the impending insolvency of the Social Security system. They both agree that the system is broken — though they can’t, or won’t, agree on how to fix it.

For most of my life I’ve happily ignored thinking about Social Security, but now that I’ve entered by 65th year — I’m paying attention! Call it enlightened self-interest.

The Social Security Administration (SSA) is ASS backwards.

“Social Security provides an interesting case study of the nation’s current political dysfunction,” writes the Washington Post Fact Checker Glenn Kessler, “Since 1995, the trustees of the old-age retirement program have warned, year after year, that a financing crunch would occur early in the 2030s, resulting in an immediate cut in benefits, unless Congress took action to address the problem.”

Unlike other social safety net programs, Social Security is not prefunded. It’s a pay-as-you-go program funded entirely by worker and employer contributions — and contributions made today are used to pay benefits today.

The money to pay social security benefits comes from the 12.4% Social Security “tax,” half paid by the employee, half by employers. While it’s true that it’s your money, you paid into the program (as did your employer), the benefit is calculated on what is becoming an unsustainable revenue generating/benefit paying model.

A giant Ponzi scheme.

In a way it’s a giant Ponzi scheme — new workers coming in pay for the benefits going out. If you’re not collecting social security yet, most of the money you paid in is likely gone. It went to paying the benefits of those who have retired. Social Security isn’t a pot of your money waiting for you to retire — it’s already in someone else’s pot.

The problem? Retiring workers are not being replaced by enough new workers who are contributing to Social Security.

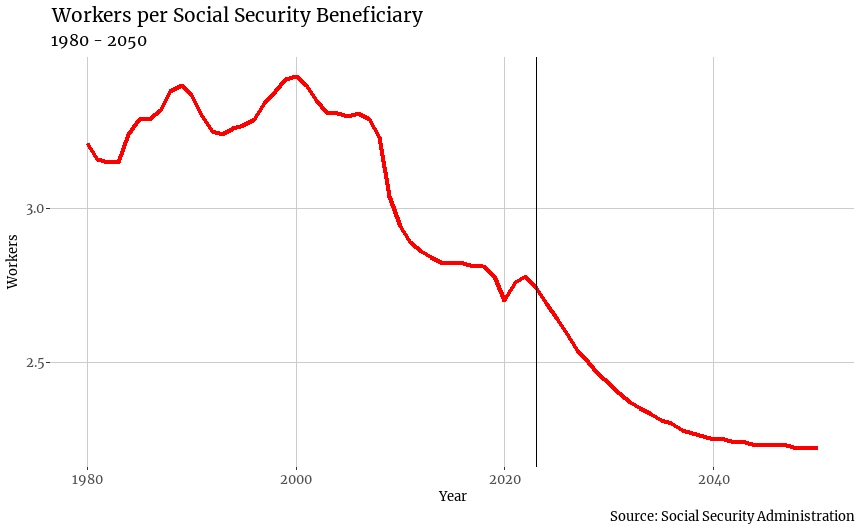

“The baby-boom generation (people born between 1946 and 1964) will have fully hit retirement age by 2031, reducing the number of workers per retiree,” notes Kessler, “Meanwhile, people are living longer and thus will collect benefits longer, while parents are not having as many children, which limits the pool of new workers.” As recently as 2000, for example, there were more than 3 working Americans paying into the system for each beneficiary. It’s projected that by 2035, there will be only about two Americans working and supporting each beneficiary.

For decades the trustees of the Social Security system have expressed concern that either the system would become insolvent or benefits would have to be drastically reduced. Back in 1995, for example, the Trustees of the Social Security program cautioned that the program “will be able to pay benefits for about 36 years.” Despite years of raised alarms, political leaders and the Social Security Administration (SSA) continue to “kick the can down the road.”

Has the Social Security Administration WOKE up?

Buried in the Appendix on page 78 of the Social Security Administration’s Annual Performance Report for Fiscal Years 2021-2023 is a harrowing warning. “The total cost of the program in 2020 was $1,107 billion, while total income was $1,118 billion,” the report cautions. “The combined OASI and DI Trust Fund reserves are projected to become depleted in 2034, at which time continuing income to the trust funds would be sufficient to pay 78 percent of scheduled benefits.”

This was one paragraph…in a more than 80 page document...and hidden in the Appendix! Talk about “burying the lead.” So, with Social Security facing insolvency, and warnings that benefits may have to be cut, would you be interested in knowing the the top two strategic goals of the SSA?

They are. according to the report, optimizing the “Experience of SSA Customers,” and building “an Inclusive, Engaged, and Empowered Workforce”.

Pardon me, but what about saving Social Security?

THAT seems like it should be THE priority — not a footnote. Is it any wonder that politicians are not taking this seriously when the federal agency tasked with administering the program doesn’t?

“So the warnings began nearly three decades ago. There’s less than ten years to go,” writes Kessler, “One would think that would generate action in Washington to deal with the problem — but Biden as president has offered no solution and Republicans, even when supposedly offering a fix, have ducked the issue as well.”

Instead of coming up with solutions, political leaders have instead come up with excuses and finger-pointing, or ignoring the problem altogether. The two most “popular” unpopular options for actually dealing with insolvency are either increasing social security taxes or decreasing future benefits by raising the eligibility age for full benefits — or a combination of the two.

“Policymakers have known for years that a long-term solution would likely require a combination of fixes,” says Kessler. “Democrats have favored raising payroll taxes or raising the income level subject to tax. Republicans have preferred raising the retirement age from 67 or changing the rate at which benefits are adjusted for inflation.”

Yet Democrats and Republicans continue to blame each other while doing nothing. Well, nothing if you don’t include fear-mongering and gaslighting. And the Social Security Administration? Well, they’re more worried about diversity than insolvency.

Kicking the FOCNN can while they should be kicking ass.

“Let me say that again: cut Social Security by $700 billion,” the Washington Post reports President Biden saying in a speech this past September, “They [Republicans] want to raise the Social Security retirement age, which means a 13 percent cut in benefits for seniors who retires at age 67. Imagine. You work your whole life. Every single paycheck you’ve had, you’ve paid into that system. You thought you’d be able to retire with a little bit of dignity.”

Instead, according to a White House statement, “The Administration is committed to protecting and strengthening Social Security and opposes any attempt to cut Social Security benefits for current or future recipients…The Administration looks forward to working with the Congress to responsibly strengthen Social Security by ensuring that high-income individuals pay their fair share.”

According to Biden, increasing taxes is the answer. A “solution” the President knows, at least for the time being, is a non-starter.

Over on the right, the Republican Study Committee, claiming as its members about 70% of House Republicans, included in its 2024 budget recommendations last June its own plan on Social Security. Like Biden’s statement, it’s heavy on finger-pointing and gaslighting and light on solutions.

“The RSC Budget also protects seniors from President Biden’s 23 percent across-the-board cuts to Social Security,” the report states, “These devastating cuts, which will occur if Congress and the White House do nothing, would leave millions of seniors unable to make ends meet and steal their ability to live with dignity and independence.”

Members of the “RSC Budget & Spending Task Force cannot be more clear," they announced in their budget report, "we will not now or ever support cutting or delaying retirement benefits for any senior in or near retirement.”

The task force instead proposed that “common-sense, incremental reforms will simply buy Congress time to come together and negotiate policies that can secure Social Security solvency for decades to come.”

Yet more “can-kicking.”

So while Democrats and Republicans are busy pointing fingers at each other, what they’re really doing is playing the fiddle while Social Security is burning. So far the extent of each party's plan is to blame the other party for not having a plan. Hoping for a miracle is not responsible public policy.

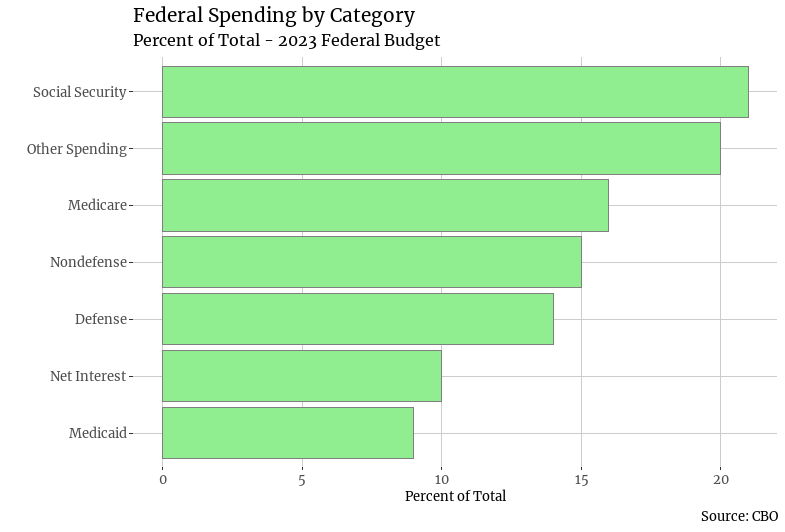

While Social Security is the “single largest federal government expenditure” — and Medicare, another partially beneficiary funded program is the third largest, it’s misleading to call them “entitlement” programs — unless, of course, you’re not entitled to get your money back through what is, in essence, a forced savings program.

The point of no return.

“Under the Trustees’ intermediate assumptions,” stated the 2023 Annual Report of the Social Security’s Board of Trustees, “Social Security’s total cost is projected to be higher than its total income in 2023 and all later years. Total cost began to be higher than total income in 2021. Social Security’s cost has exceeded its non-interest income since 2010.” According to the SSA, Social Security “is not sustainable over the long term at current benefit and tax rates.” We are, say some experts, nearing the point of no return.

“If we wait until the 2030s, it’s all over,” Charles Blahous, a former Social Security trustee now at George Mason University’s Mercatus Center, told Kessler. “At that point, there is no plausible likelihood that lawmakers could repair Social Security’s finances in a way that preserves its design as a self-financing earned benefit. They would have to abandon self-financing, meaning bail out the program from general revenues, thereby terminating the link between contributions and benefits. Gone forever would be any sense in which workers earned their Social Security benefits, and with it, the unique political protections Social Security has always enjoyed.”

During the recent Presidential primaries the only candidate who was talking seriously about fixing Social Security was Republican Nikki Haley. Haley proposed raising the age for collecting the benefit for those not yet, or just barely, contributing — say those workers now in their 20’s, and limiting benefits for the wealthy.

“What the hell is a guy like me (doing) getting $3,500 a month from the government?” Ken Langone, the billionaire founder of Home Depot, whose net worth Forbes pegs at more than $7 billion, said of his monthly Social Security benefits. “That’s outrageous. I shouldn’t get a nickel.”