Tax the rich...till there are no rich no more!

Is it fair to claim the rich don't pay their fair share?

Nothing is certain Benjamin Franklin joked, “except death and taxes.” And while the rich haven’t learned to cheat death just yet (with the possible exception of Keith Richards)—progressives, and some prominent economists, are certain they’ve learned to cheat on their taxes—and stick you, and me, with the bill while they’re at it.

In a recent Guest Essay in the New York Times, economist and Cal Berkley professor Gabriel Zucman says “It’s Time to Tax The Billionaires”—with the implication that we don’t. “We’ve found that the ultrawealthy,” he writes, “consistently avoid paying their fair share in taxes.” According to Zucman, Amazon’s founder, billionaire Jeff Bezos, had an income of just $81,840 in 2018—and so escaped paying taxes on his billions, leaving the rest of us to pay his share.

Pitting the “have” versus the “have-nots” with catchy slogans like “Tax The Rich” and “We are the 99%,” or headlines like Zucman’s, are a staple of progressive populism, fueling the perception that the wealthy have rigged the system to avoid paying taxes. “Wall Street billionaires and multi millionaires have used their wealth and power to shape laws that result in their tax rates being much lower than the rates paid by working people,” Lisa Donner, the executive director of Americans for Financial Reform said in support of US Senator Elizabeth Warren (D-MA) and Representative Primala Jayapal’s (D-WA) “Ultra-Millionaire Tax” legislation. “Enough is enough.”

In his State of the Union speech this past February President Biden also played the “Tax The Rich” card, proposing a spate of tax increases with the goal of “finally making the wealthiest and biggest corporations begin to pay their fair share. Just begin.”

So, is it true, like Lisa Donner, of Americans for Financial Reforms claims, that the wealthy pay a lower tax rate than “working people,” or like President Biden says, that the wealthiest don’t pay their fair share?

I pity the fool.

“Mr. Biden likes to cherry pick the example of the odd billionaire who might pay a small amount of tax in a given year,” according to the Wall Street Journal, “But in the aggregate the top 1% in 2020 earned at least about $550,000 and paid an average income-tax rate of 26%. Those making more than $220,000 but less than $550,000 paid an average rate of 17.5%. For those in the next grouping, above about $150,000, it’s 13.1%. Above $85,000, 9.5%. Above $42,000, 6.5%. And the bottom 50% of taxpayers, those below about $42,000, paid an average rate of 3.1%.”

While President Biden and Senator Warren claim that the wealthy don’t pay their fair share of taxes, the most recent data from the IRS reveals that the top 1% of income earners paid 42% of all income taxes in 2020. “The Stat is literally true. But it is deeply misleading — so misleading, in fact,” complains Jonathan Chait in New York magazine, “that it routinely fools even the people who are citing it into thinking it indicates something other than what it actually means…the figure lacks any context when it omits how much money they earn in the first place.”

It turns out, however, that the one fooling themselves is Mr. Chait. While acknowledging that the top 1% do pay 42% of all federal income taxes, he conveniently ignores the “Stat” that the 42% of taxes paid by the wealthiest Americans comes from only 22% of all earnings. The highest earners pay a rate double, or way more, than most taxpayers. The top 50% of income earners, according to the IRS, pay nearly 98% of all federal income taxes. How’s that for a stat?

That’s the “context” that Chait—and others claiming the rich don’t pay their “fair” share—dodge. So, who’s misleading who? The “basic truth,” writes the Wall Street Journal, “is that the rich really do pay their fair share and finance an enormous portion of the government.”

These percentages, as damning as they are to the “fair” share argument, also don’t account for state and local taxes. “The current federal income tax that Americans pay today has a top marginal rate of 37%,” notes a Wall Street Journal editorial, “Add state and local income taxes, and the top marginal rate hits 50.3% in California and 51.8% in New York City.” How is it that Warren, Biden et al, can say—with a straight face—that taking up to half of someone’s income is not enough?

According to Gerald Auten of the U.S. Treasury Department and David Splinter, of Joint Committee on Taxation, U.S. Congress, while “state and local income taxes increased substantially for the top one percent…increasing government transfers and tax progressivity have resulted in rising real incomes for all income groups and little change in after-tax top income shares.”

While there are some wealthy taxpayers who pay no federal income tax in a given year “they are likely a small share of nonpayers,” Howard Gleckman, senior fellow at the Tax Policy Center said. “The tax code is actually quite progressive. There may be some cases where someone with a lot of wealth has little income, or they realize gains and offset those with losses or a charitable deduction. But that’s unusual.”

If you’re losing the debate, shift the narrative.

Confronted with the inconvenient truth that the rich actually pay a majority of the nation’s income taxes, the Elizabeth Warrens, Bernie Sanders, and Alexandria Ocasio-Cortez’s, have instead switched their focus to taxing wealth. They want to start taxing Americans not just on what we make—but what we own.

Sure, for now their sights are set on the upper of the upper classes, but how long do you think it will take, once that’s not enough, to start moving the goalposts? The real problem, Margret Thatcher once quipped, “is that you eventually run out of other people’s money.”

A common metaphor for wealth is the idea of a “pie”—that the economy is a fixed amount of wealth, and whatever you have means less for everybody else. The rich get the filling—the poor get the crumbs.

“There is no pie,” write Yaron Brook and Don Watkins in Forbes. “One implication of the pie metaphor,” they note, “is that wealth is a zero-sum game: there is a fixed amount of houses, cars, medicines, etc. to go around, and the more Steve Jobs gets the less is left for the rest of us. That may have had some plausibility 250 years ago when most wealth was in the form of land. But today…it's impossible to miss the fact that wealth grows.“

The founder and President of the Adam Smith Institute, Madsen Pirie, calls it the Zero Sum Fallacy. “The poor don’t improve their lot by having wealth confiscated from the rich,” he argues, "They do it by being part of an economy that grows.”

Eric Neilsen, of the Federal Reserve Bank of Richmond, explains it this way.

[T]he total amount of wealth in the world is not fixed. Consider the example of Henry Ford and the automobile. In 1908, Ford introduced the Model T, the first mass-produced and widely affordable car in history. Through his innovative use of assembly lines, Ford was able to produce reliable cars at relatively low cost. By 1927 he had sold 15 million cars, his company employed well over 100,000 workers at wages double industry standards, and almost 7,000 Ford dealerships had been opened across the country. Needless to say, Ford himself became extremely wealthy in the process. However, Ford also greatly increased the wealth of countless others through his innovations. He provided high-paying jobs to thousands of workers while producing a much-valued new good to the burgeoning middle class.

“My students arrive at my class steeped in zero-sum ideas,” writes Robert Parham, a professor of economics at the University of Virginia, in The Free Press, “in which one person’s gain must be another person’s loss, and the only way to get a thing is by ‘oppressing’ it from someone else. Then, they are shocked to hear heretical ideas about a world in which wealth is created, not stolen, and human interactions can be win-win and make all of us immensely well-off.”

All’s fair in Love and Class-warfare.

“For too long billionaires have played by a different set of rules that allow them cheat the system and pay nothing in taxes," US Senator Ron Wyden (D-OR) grumbled in a press release announcing his "Billionaires Income Tax" legislation. "No working person in America," Wyden said, "thinks it’s right that they pay their taxes and billionaires don’t."

Is that true? Do American’s hate the rich as much as Wyden and some left-leaning politicians seem to, or think we do? The answer might depend as much on your politics as your pocketbook.

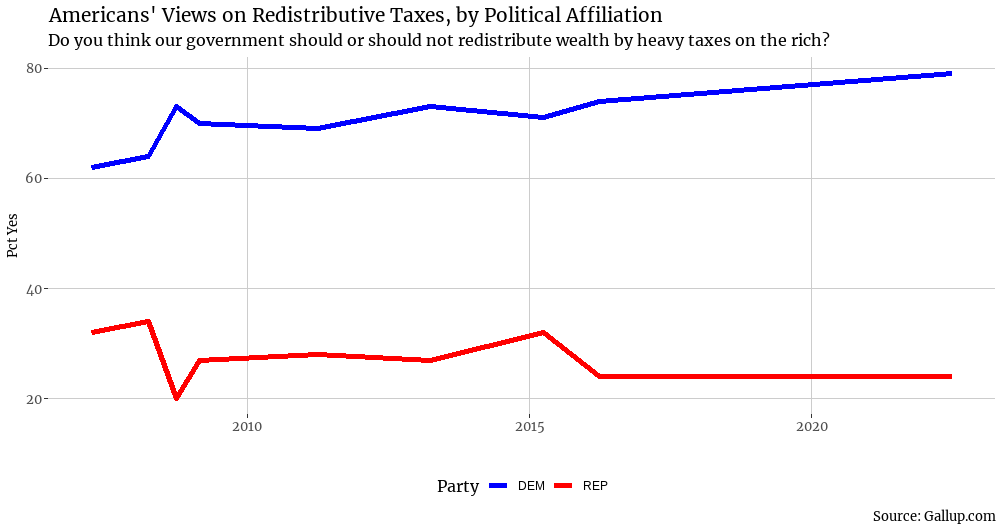

A recent Gallup survey found there’s a deep partisan divide over how much we should tax the richest Americans. Democrats and Republicans, according to Gallup, differ dramatically on how they answer the question “Do you think our government should or should not redistribute wealth by heavy taxes on the rich?”

“About seven in 10 Democrats and Democratic-leaning independents have supported heavier taxes on the rich each time the classic Gallup question has been asked since October 2008,” according to Gallup. “That compares to a consistent third or less of Republicans. In July's [2023] update, 79% of Democrats support the idea of heavy taxes on the rich; 24% of Republicans agree.”

To what can we attribute this huge divergence of opinion? Writing in the New Republic during the runup to the 2020 Democratic primaries, Melissa Gira Grant observed that “Members of the new class of Democrats in Congress have made particularly effective use of populist, anti–Wall Street politics…As the Democratic primary for the 2020 election wears on, it’s clear that the class-war politics some thought would vanish with the Occupy encampments has, instead, become commonplace.”

According to a recent survey conducted by the Tax Foundation, a non-partisan organization that analyzes tax policies around the world, 33% of Democrat respondents thought that the top 1% of taxpayers only pay 1% of the taxes—far off the true figure of 42%. This “suggests,” writes the Wall Street Journal’s editorial board, “that the left’s ‘fair share’ mantra has sunk in.”

Perhaps no tax rate less than 100% would satisfy some on the left, nor more than 0% for some on the right. Representative Alexandria Ocasio-Cortez, for example, has called for a 70% income tax on all income above $10 million. Some House Republicans have suggested eliminating the income tax altogether, instead replacing it with a 30% national sales tax.

And while progressives are calling for those who pay the most taxes to pay more, some conservatives are calling for those who pay nothing to pay something. US Senator Rick Scott (R-FL), a founding member of the conservative Freedom Caucus, has said “all Americans should pay some income tax to have skin in the game.” According to the nonpartisan Tax Policy Center, a plan calling for all Americans to pay at least $100 in income taxes would have raised $100 billion in revenue in 2022.

Do as I say, not as I do.

Back in March 2024, President Biden announced that he was “fighting to make the tax system fairer,” and proposed a plan to make “the wealthy to pay their fair share,” by requiring “all Americans to play by the same rules and pay the taxes they owe.”

I would be remiss if I didn’t remind folks that this is more than a bit hypocritical coming from Joe Biden. In his and Jill Biden’s 2017 and 2018 federal tax returns, they shifted a significant chunk of fees they received for consulting and public speaking through an S corporation, and by doing so skirted somewhere between $280,000 and $500,000 in additional taxes on income of $7.5 million.

“I don’t have any problem with what he did. In fact, he would have been almost derelict had he not channeled his earnings through an S corporation,” said Robert Willens, a Columbia University business school professor who also serves as a tax fact checker for the Washington Post. “I’ll leave the morality of him adopting this strategy, particularly given his track record of attempting to ensure that everyone pays their fair share of taxes, to others to comment on.”

Some might say, “what about Trump?” But Donald Trump is not the one calling for the rich to pay their fair share while using the same accounting tricks they do to reduce his taxes—Joe Biden is.

A taxing problem. Or a spending one?

Maybe the right question is not “are the rich paying enough,” but “are we spending too much?” The US government is already a massive income redistribution machine, churning trillions from taxpayers into mostly social and safety net programs. Paul Krugman, the liberal economist and New York Times columnist, recently described the federal government as “essentially an insurance company with an army.”

According to the Office of Management and Budget, human services—including education, health, Social Security, Medicare, income security and veterans benefits—already accounts for 66% of federal government spending. Another 13% goes to net interest on a staggering government debt in excess of $34 TRILLION, leaving the 20% that’s left for national defense and all other functions of the federal government. If, for example, you took ALL the wealth from the Forbes richest 400 Americans—every penny—you could only pay down about 13% of the total national debt.

“Some people now call for the wealth of billionaires to be confiscated and distributed,” says Madsen Pirie, “If they did their sums, they would see that people would receive only tiny amounts if this were done, and it would be a one-off that couldn’t be repeated.”

To put this in perspective, say we decided to tax the “ultra” wealthy along the lines being advocated by Warren and Sanders—as high as 3% of total wealth. If you taxed the wealth of the 400 richest Americans at that rate—their stocks, bonds, homes, everything they own—that would raise somewhere around $150 billion per year. While that sounds like a lot, it’s nowhere near enough to even dent this year’s projected federal budget deficit, forget about any new spending.

“The deficit totals $1.6 trillion in fiscal year 2024,” reports the non-partisan Congressional Budget Office, “grows to $1.8 trillion in 2025, and then returns to $1.6 trillion by 2027. Thereafter, deficits steadily mount, reaching $2.6 trillion in 2034.” A 3% tax won’t even cover 10% of this year’s deficit, let alone the mounting deficits in the coming years.

“Tax The Rich” advocates can whine all they like about what’s “fair,” but the truth is they are using the “fair share” argument to deflect from the bigger issue—that the federal government spends way more than it has—or realistically can ever expect to get. “The problem,” former President Ronald Reagan once remarked—and which is as relevant today as when he first said it— “is not that people are taxed too little, the problem is that government spends too much.”

That’s what doesn’t sound fair.